Investors with wealth advisors do better.

Plans starting at $25 per month.

Plan Details

Dedicated Wealth Advisor. Unlimited investing. One flat monthly fee.

Plus: Coming Soon, Mora, your AI Wealth Coach

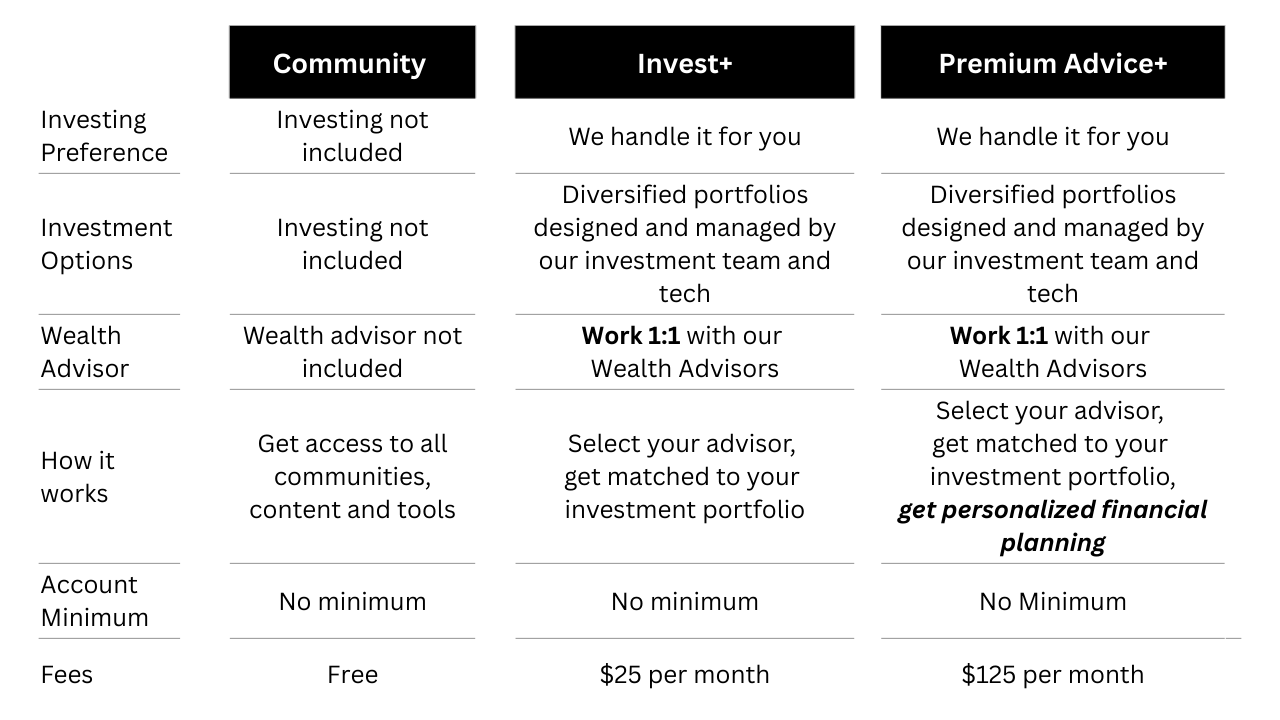

Community*

For all wealth builders

Free

Invest+ Plan

Designed for investing with advice

$25 per month

Premium Advice+

Designed for complete investing and planning

$125 per month

*Community plan is not an investing or advisory account. Community plan is for educational purposes only. Community plan includes access to (1) all our advisor led communities - #homebuying, #newbieinvestors, #cashflowmanagement, #womenwhowealth, #menwhowealth and (2) our exclusive, interactive Wealth Plan tool for help with cash flow management, home buying, tax optimization, and retirement planning and more

** Invest+ and Premium Advice+ Plans include all Community Plan benefits

***Premium Advice+ additional benefits: Link your external accounts right on desktop or in the mobile app, advice on all your investment accounts; that includes individual and workplace accounts, e.g. 401(K)s; quarterly financial reviews with your dedicated wealth advisor; Complete financial planning from home buying, taxes, estate planning, insurances, college planning, to retirement planning; includes scenario analysisCompare Our Plans

Dedicated Wealth Advisor. Unlimited investing. One flat monthly fee.

*Community plan is not an investing or advisory account. Community plan is for educational purposes only.We’re not like the others

We were built to be different. We combined the best of traditional advice with modern technology and community support. Here's how we compare to the old-school firms, robo-advisors, and DIY solutions.

WealthMore

- Advisor Access: Dedicated advisors

- Minimums: $0

- Pricing: $0–$125/mo flat fee

- Wealth Plan: Included

- AI + Human: Mora + Advisors

- Community: 20+ Groups

Traditional Firms

- Advisor Access: $250K–$1M+ required

- Minimums: $100K+

- Pricing: 1% AUM + addt'l fees

- Wealth Plan: Often extra

- AI + Human: Human advisors only

- Community: Not offered

Robo-Advisors

- Advisor Access: No human advisors

- Minimums: $500+

- Pricing: % AUM + upsells

- Wealth Plan: Goal-based

- AI + Human: Technology platform only

- Community: Not offered

DIY

- Advisor Access: No human advisors

- Minimums: No

- Pricing: varies, add ons and upsells

- Wealth Plan: Not offered

- AI + Human: Technology platform only

- Community: Not offered

Getting Started

-

WealthMore is a wealth manager, online financial advisor, and community of achievers. We focus on helping you do better.

WealthMore works with you to help you grow your wealth. We are a fiduciary. We act in your best interest.

We offer the wealth advice you need to grow and retain wealth in every aspect of your financial life from cash flow management to estate planning to retirement. Our wealth advisors are CERTIFIED FINANCIAL PLANNERS™.

For your long-term financial needs (like retirement, home buying), our approach is an investment strategy built on low-cost ETFs (exchange-traded funds), your risk profile, and how long you plan to invest supported by advice, insights, and updates.

-

We’re built for busy professionals, first-gen wealth builders, and anyone who wants expert guidance without high fees or account minimums.

Whether you're starting out or leveling up, WealthMore meets you where you are.

-

No. There are no account minimums. You can start with any amount—truly.

-

WealthMore makes money in two simple ways:

Our Invest+ Plan is a flat fee of $25 per month.Our Premium Advice+ is a flat fee of $125 per month.

There is no account minimum and no percentage of AUM charged.

We don't earn revenue from any funds we've selected for your portfolio. We also don't make money in our trading practices. We're a fiduciary, always. -

During onboarding, you answer a few simple questions about your goals, timeline, and comfort with risk. Based on your responses, you're matched to the best WealthMore plan and investment portfolio for your needs.

-

WealthMore offers features, including:

Investment and financial planning advice from our professional wealth advisors whenever you need it.

A simple flat fee only pricing model with no transaction charges or hidden fees.

We focus on the only two investments which tend to matter to most investors: a diversified stock basket and a bond portfolio leveraging low cost ETFs

An easy user experience which makes it easy to understand your money and control your exposure to risk.

Automatic, seamless diversification (which often means higher returns with lower risk).

Automatic rebalancing of your portfolio.

Automatic reinvestment of your dividends.

Transaction in exact dollar amounts (so you don't have to buy whole shares).

-

All customers must be at least 18 years of age and reside in the United States.

Currently, WealthMore only operates in the United States. For regulatory reasons, we cannot accept international customers residing outside the United States. This also includes U.S. citizens residing and/or working abroad.* Login access to WealthMore’s application and/or website may be blocked in certain countries.All customers must be at least 18 years of age in order to consent to all our agreements.

*WealthMore supports residents in Puerto Rico and the Virgin Islands. We currently do not support residents in Guam.

**WealthMore supports U.S. military personnel residing abroad with a valid U.S. address on file, including Army Post Office box.

-

No. WealthMore does not lend out money. We do not pull your credit score. The only check we do is an identification (ID) verification as required by law.

-

Yes. You can book a Free Intro Call to meet an advisor, ask questions, and explore which plan fits you best.